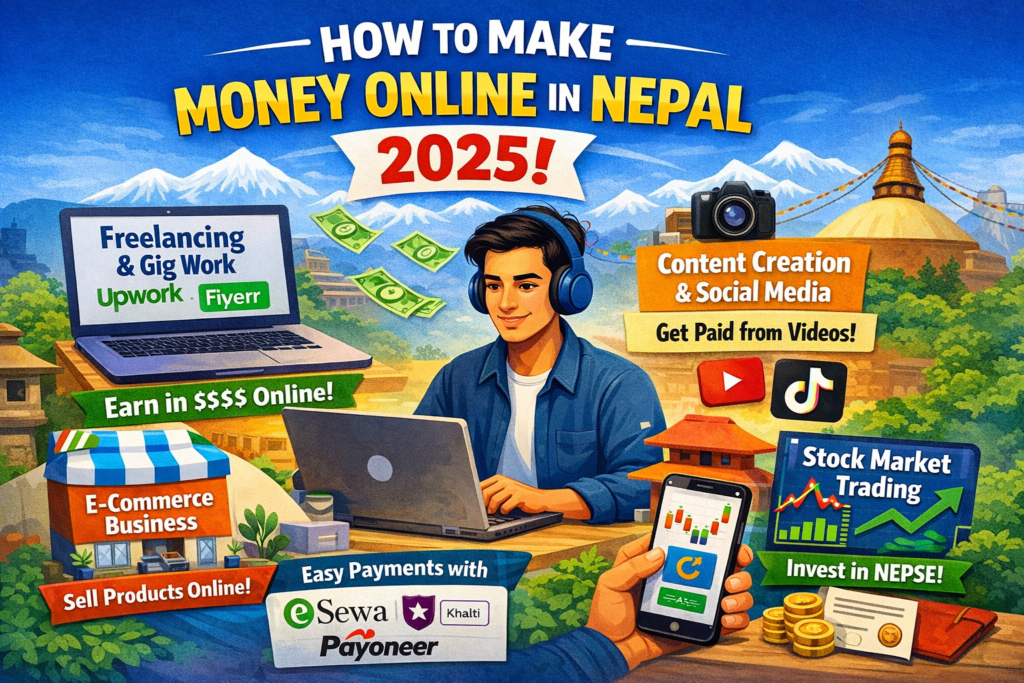

Investing in the Nepal Stock Exchange (NEPSE) is an excellent way to build wealth through share market investments, stock trading, IPOs, FPOs, right shares, bonus shares, and Secondary Market opportunities in the Nepalese capital market. As of December 2025, NEPSE operates fully digitally with advanced online trading systems, making it highly accessible for beginners interested in NEPSE stocks, NEPSE index, and live trading.

Here’s a complete beginner-friendly guide to starting your journey in the NEPSE share market:

Step 1: Open a Demat account

A Demat account is essential for holding shares electronically in dematerialized form (no physical certificates required) under the supervision of CDSC (Central Depository System and Clearing Limited).

- Choose a Depository Participant (DP) – typically banks or merchant bankers (e.g., Global IME Bank, Nabil Invest, Siddhartha Capital).

- Many DPs offer fully online Demat opening (e.g., via apps like “Ek Sath 5” from Global IME).

- Required Documents:

- Citizenship certificate/passport copy

- Passport-size photo

- Bank account details

- Cost: Free or nominal (annual renewal ~Rs. 100, plus DP fees and SEBON fees).

- Time: 1-3 days (faster with online Demat applications).

- You’ll receive a 16-digit BOID number for your Demat holdings.

Step 2: Register for MeroShare

MeroShare (meroshare.cdsc.com.np) is the essential online portal for viewing your portfolio, applying for IPOs, FPOs, right shares, checking allotments, and managing Primary Market investments.

- Often auto-registered during Demat opening (or apply separately via your DP).

- Obtain a CRN (C-ASBA Registration Number) from your bank for seamless payments.

- Login: Select your DP, enter username/password provided by the DP.

Step 3: Choose a Licensed NEPSE Broker

You require a SEBON-licensed stock broker (approximately 92 NEPSE brokers as of 2025) to execute trades in the secondary market.

- Compare brokers on platforms like sharesansar.com, merolagani.com, or nepsealpha.com (check top brokers, floorsheet, and turnover).

- Popular choices: Naasa Securities (Broker 58), Kumari Securities, and others with advanced platforms.

- Open a trading account (many support fully online applications).

Step 4: Get NEPSE TMS Access

NEPSE TMS (Trading Management System) is the powerful online trading platform for buying/selling shares in the secondary market.

- Your broker provides username/password and a unique TMS URL (e.g., tmsXX.nepsetms.com.np or custom platforms like NaasaX).

- Login to place orders, monitor live NEPSE trading, view floorsheet, check today's share price, analyze NEPSE charts, and manage your portfolio.

Step 5: Fund Your Account and Start Investing

- Link your bank account for seamless transfers.

- For Primary Market (IPOs/FPOs): Apply easily via MeroShare – ideal for beginners with lower risk and potential quick gains.

- For Secondary Market: Use TMS to buy/sell listed shares.

- Trading Hours: Sunday-Thursday, 11 AM to 3 PM.

- Minimum Investment: As low as Rs. 1,000 (based on share price).

Key Tips for Beginners in NEPSE

- Educate yourself: Follow NEPSE news, charts, technical analysis, and fundamental analysis on sites like sharesansar.com, merolagani.com, nepsealpha.com.

- Start small and diversify across dominant sectors like banks, hydropower, insurance, and microfinance.

- Risks: The NEPSE market is volatile – invest only disposable funds.

- Taxes: Capital gains tax at 5-10% (depending on holding period and entity); plus broker commission, DP/SEBON fees.

- Resources: Official NEPSE site (nepalstock.com.np), SEBON for regulations.

Many newcomers begin with IPOs via MeroShare as it’s simpler and often safer. Always consider consulting a financial advisor. Happy investing in the dynamic Nepal Stock Exchange (NEPSE) and the growing Nepalese capital market!

Disclaimer

Meroshare.net is an independent website and is not affiliated with CDSC, NEPSE, SEBON, or the official MeroShare platform. For account-related issues, contact your broker or the relevant authorities directly.

The content in this page is based on publicly available sources and is provided for informational purposes only. It may contain inaccuracies or outdated information and does not constitute financial or investment advice or a recommendation to buy, sell, or hold any securities.

Always conduct your own research and consult qualified professionals before making investment decisions. For official information, refer directly to the relevant companies or authorities.